Yes, we do it all

Implement new accounting and financial reporting requirements. Structure transactions. Evaluate the impact on regulatory capital. Analyze profitability. Structure merger and acquisition transactions.

We do it all.

And we do it with focused knowledge in financial institution accounting. Our team includes advisors who receive specialized training in financial institution accounting throughout the year.

So you can trust us to do it all — and do it with deep industry knowledge.

Let us handle your financial institution accounting needs:

100+

Financial institution clients served annually

1,400+

Hours of training logged by manager-level staff each year

2019 - 2022

Named as a Regional Leader by Accounting Today

Team

We have an entire team dedicated to financial institution accounting

Meet Our TeamMeet the firm partners who lead our financial institution accounting team.

- Assistance provided during regulatory examinations

- Assistance with risk assessment procedures

- Develop internal audit procedures based on risk assessments

- Directors’ examinations

- Financial statement audits

- Interviews and questionnaires to document policies and procedures

- Other agreed-upon procedures

- Perform internal audit procedures based on bank provided programs

- Presentations to the audit/compliance committee or full board of directors

- Review of bank policies

- Training and assistance to internal audit staff

- Call report preparation

- Compilation and submission of Y9 reports

- Holding company level tax planning

- Merger/acquisition evaluation and accounting

- Monthly depreciation schedule and tax projection updates and reporting

- Tax return preparation

Let our advisors handle your financial institution accounting needs

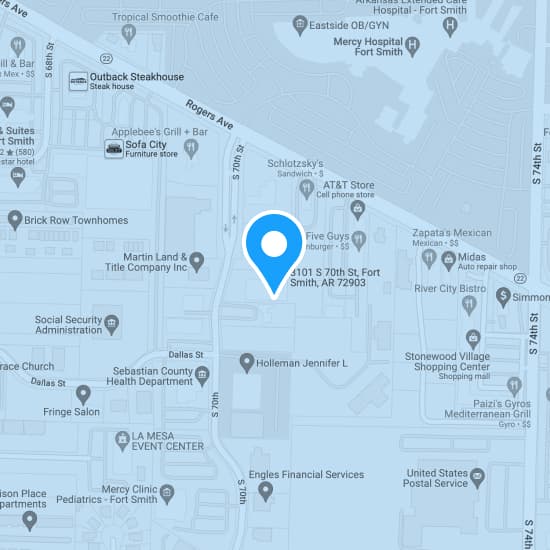

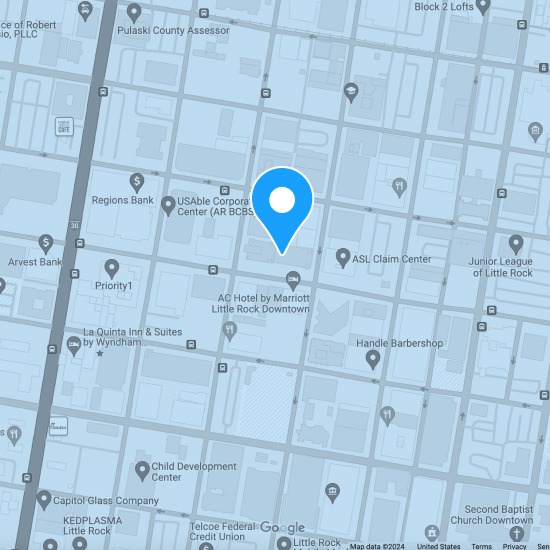

Locations We Serve

Landmark serves clients locally and nationwide from our 6 offices across Arkansas and Arizona.

Arkansas Financial Institution Accounting

Little Rock, AR

200 W. Capitol Ave., Suite 1700

Little Rock, AR 72201

(Inside the 200 West building)

501.375.2025

Learn more

Arizona Financial Institution Accounting

Across the United States

Are you located outside of Arkansas or Arizona?

No matter where you call home, we provide financial institution accounting to clients across the United States.

Featured Insights

Explore our financial institution and other insights.