This year, some businesses are thriving while others are still struggling to recover from the pandemic and resulting economic crisis. Whatever your business’s situation, taking full advantage of available tax breaks for small businesses — including temporary relief in response to the crisis — is critical. And changes under the TCJA still demand attention, too.

Business structure

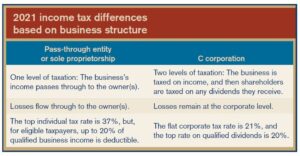

Income taxation and owner liability are the main factors that differentiate business structures. Many owners choose entities that combine pass-through taxation with limited liability, namely limited liability companies (LLCs) and S corporations.

The TCJA significantly changed the tax consequences of business structure. The now-flat corporate rate (21%) is substantially lower than the top individual rate (37%), providing sizable tax benefits to C corporations and mitigating the impact of double taxation on owners. But, the TCJA also introduced a powerful deduction for owners of pass-through entities. (See below.)

Depending on your situation, a structure change may sound like a good idea. But keep in mind that increases to both the corporate rate and the top individual rate have been proposed. Even if there are no tax increases, a change could have unwelcome tax consequences. Consult your tax advisor if you’d like to explore whether a structure change could benefit you.

199A deduction for pass-through businesses

Through 2025, the TCJA provides the Section 199A deduction for sole proprietorships and owners of pass-through entities. The deduction generally equals 20% of qualified business income (QBI), not to exceed 20% of taxable income. QBI is generally defined as the net amount of qualified items of income, gain, deduction and loss that are connected with the conduct of a U.S. business.

Additional limits begin to apply if 2021 taxable income exceeds the applicable threshold — $164,900 or, if married filing jointly, $329,800 ($164,925 if married filing separately). The limits fully apply when 2021 taxable income exceeds $214,900 and $429,800 ($214,925), respectively.

One such limit is that the 199A deduction generally can’t exceed the greater of the owner’s share of:

- 50% of the amount of W-2 wages paid to employees by the qualified business during the tax year, or

- The sum of 25% of W-2 wages plus 2.5% of the cost of qualified property.

Another is that the 199A deduction generally isn’t available for income from “specified service businesses.” Examples include businesses that provide investment-type services and most professional practices (other than engineering and architecture).

To reiterate, none of these limits apply if your taxable income is under the applicable threshold.

Projecting income

Projecting your business’s income for this year and next can allow you to time income and deductions to your advantage. It’s generally — but not always — better to defer tax, so consider:

Deferring income to next year. If your business uses the cash method of accounting, you can defer billing for products or services at year-end. If you use the accrual method, you can delay shipping products or delivering services.

Accelerating deductible expenses into the current year. If you’re a cash-basis taxpayer, you may pay business expenses by Dec. 31, so you can deduct them this year rather than next. Both cash- and accrual-basis taxpayers can charge expenses on a credit card and deduct them in the year charged, regardless of when the credit card bill is paid.

Warning: Don’t let tax considerations get in the way of sound business decisions. For example, the negative impact on your cash flow or customers may not be worth the tax benefit.

Taking the opposite approach. If your business is a pass-through entity and it’s likely you’ll be in a higher tax bracket next year, accelerating income and deferring deductible expenses may save you more tax over the two-year period.

Depreciation

For assets with a useful life of more than one year, you generally must depreciate the cost over a period of years. In most cases, the Modified Accelerated Cost Recovery System (MACRS) will be preferable to other methods because you’ll get larger deductions in the early years of an asset’s life.

But if you make more than 40% of the year’s asset purchases in the last quarter, you could be subject to the typically less favorable midquarter convention. Careful planning can help you maximize depreciation deductions in the year of purchase.

Other depreciation-related breaks and strategies may be available:

Section 179 expensing election. This allows you to currently deduct the cost of purchasing eligible new or used assets, such as equipment, furniture, off-the-shelf computer software, qualified improvement property, certain depreciable tangible personal property used predominantly to furnish lodging, and the following improvements to nonresidential real property: roofs, HVAC equipment, fire protection and alarm systems, and security systems.

For qualifying property placed in service in 2021, the expensing limit is $1.05 million. The break begins to phase out dollar for dollar when asset acquisitions for the year exceed $2.62 million.

Bonus depreciation. This additional first-year depreciation is available for qualified assets, which include new tangible property with a recovery period of 20 years or less (such as office furniture and equipment), off-the-shelf computer software, and water utility property.

Under the TCJA, through Dec. 31, 2026, the definition has been expanded to include used property and qualified film, television and live theatrical productions. For qualified assets placed in service through Dec. 31, 2022, bonus depreciation is 100%. For 2023 through 2026, bonus depreciation is scheduled to be gradually reduced. For certain property with longer production periods, these reductions are delayed by one year.

New! Qualified improvement property is now eligible for bonus depreciation.

Warning: Under the TCJA, in some cases, a business may not be eligible for bonus depreciation. Contact us for details.

READ MORE: Tax Depreciation Rules for Business Vehicles

Tax credits

Tax credits reduce tax liability dollar for dollar, making them particularly beneficial:

Research credit. This credit gives businesses an incentive to increase their investments in research. Certain start-ups (in general, those with less than $5 million in gross receipts) can, alternatively, use the credit against their payroll tax. While the credit is complicated to compute, the tax savings can prove significant.

Work Opportunity credit. This credit is designed to encourage hiring from various disadvantaged groups, such as certain veterans, ex-felons, the long-term unemployed and food stamp recipients. The maximum credit is generally $2,400 per hire but can be higher in some cases — up to $9,600 for certain veterans, for example. New! The CAA has extended this credit through Dec. 31, 2025.

New Markets credit. This gives investors who make “qualified equity investments” in certain low-income communities a 39% credit over a seven-year period.

New! The CAA has extended this credit through Dec. 31, 2025.

Family and medical leave credit. The TCJA created a tax credit for qualifying employers that begin providing paid family and medical leave to their employees. The credit is equal to a minimum of 12.5% of the employee’s wages paid during that leave (up to 12 weeks per year) and can be as much as 25% of wages paid.

New! The CAA has extended this credit through Dec. 31, 2025.

Additional rules and limits apply to these credits, and expiring credits might be extended. Other credits may also be available to you. Check with us for more information.

READ MORE: Tax Credits and Incentives for Businesses in 2021

The self-employed

If you’re self-employed, you have to pay both the employee and employer portions of employment taxes on self-employment income. The employer portion is deductible “above the line,” which means you don’t have to itemize to claim the deduction.

In addition, you can deduct 100% of health insurance costs for yourself, and for a spouse and children, too. This above-the-line deduction is limited to net self-employment income. You also can take an above-the-line deduction for contributions to a retirement plan and, if eligible, an HSA for yourself.

If your home office is your principal place of business (or used substantially and regularly to conduct business) and that’s the only use of the space, you probably can deduct home office expenses from your self-employment income.

READ MORE: 3 Tax Breaks for Small Businesses

More tax breaks for small businesses

There are several other ways to maximize your tax savings if you own a business including vehicle-related depreciation, meals, entertainment and transportation, and employee benefits. For help with tax planning or questions about tax breaks for small businesses, contact us today for a free consultation.