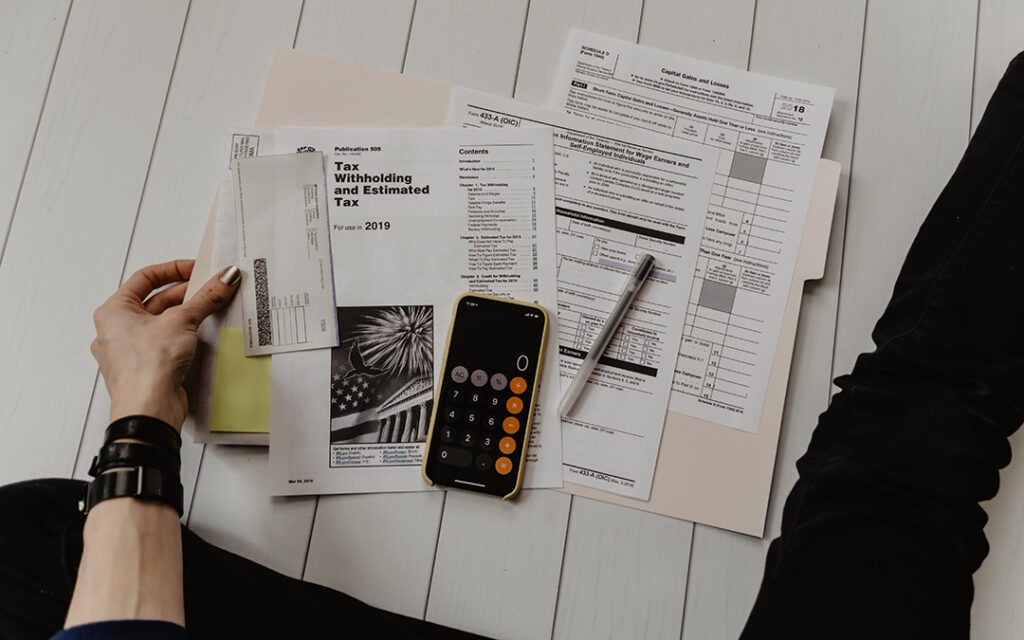

Because of the restrictions for cars, you might be better off from a tax standpoint if you replace your business car with a heavy SUV.

What You Need to Know About the Heavy SUV Tax Break

Because of the restrictions for cars, you might be better off from a tax standpoint if you replace your business car with a heavy SUV.

You’re probably aware of the 100% bonus depreciation tax break. Here are five key points to be aware of when it comes to this powerful tax-saving tool.

An array of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2020.

Don’t let the holiday rush keep you from taking some important steps to reduce your 2019 tax liability. You still have time to execute a few strategies.

Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability.

It’s an easy decision to set a website up and maintain it. But determining the proper tax treatment for the costs involved isn’t so easy.

There’s good news about the Section 179 depreciation deduction for business property. The election has long provided a tax windfall to businesses, enabling them to claim immediate deductions for qualified assets, instead of taking depreciation deductions over time. And it was increased and expanded by the Tax Cuts and Jobs Act (TCJA). Even better, the

The Tax Cuts and Jobs Act changed the rules for business autos. Here are a few highlights.

A variety of tax-related limits affecting businesses are annually indexed for inflation, and many have gone up for 2019. Here’s a look at some that may affect you and your business.

Special tax breaks that allow deductions to be taken more quickly are available for certain real estate investments. There are two breaks you might not be able to enjoy due to a drafting error in the TCJA.